Executive Summary

Background

In 2013, the Health Industry Distributors Association began a Thought Leaders initiative to provide insights on the unprecedented changes occurring in healthcare markets. McKinsey & Company conducted in-depth interviews with dozens of healthcare provider executives across healthcare settings. HIDA’s own Thought Leaders then developed recommendations for the industry as a whole.

The top recommendation from these leaders: fix the contracting process. As one participant stated, “We’re all doing these incremental customer agreements individually, independently. This adds a cost for all of us. What we need to do, as an industry, is unite for a standard contracting process.”

This white paper reflects the industry-wide effort to identify and communicate contract management standards. The process is continuous, resulting from ongoing work to support progress as it is made.

Driving Forces

In today’s healthcare environment, wasteful costs can no longer be tolerated. Pricing discrepancies increase operating costs for providers, group purchasing organizations (GPOs), manufacturers, and distributors.

In an effort to move toward greater pricing alignment, HIDA’s Contract Administration Workgroup has developed industry standards to reduce pricing exceptions between trading partners.

These recommendations aim to improve contract administration processes based on three guiding principles:

- Automation: 100% of communications and transactions should be electronic. Any process that cannot be automated should be redesigned.

- Standards: Non-standard processes and identifiers create confusion and add cost. For product and location identification, GS1 standards are strongly encouraged. For transactions, EDI (electronic data interchange) formats are the gold standard for communicating information, with CSV files matched to EDI formats an acceptable alternative.

- Timeliness: All parties need to embrace contract negotiation deadlines that allow timely notice of contract changes, regardless of contract type, so that everyone has time to load accurate pricing and avoid mismatches and costly rework.

Solving pricing alignment issues is extremely challenging. Thousands of non-standard business processes, definitions, and data formats exist. It also seems that every supply chain relationship creates new and unique questions to answer.

Summary Recommendations

This paper details specific processes for standardizing contract communications and contract activation timing. Standard fields, definitions, and order of elements are explained and an accompanying template is provided.

The recommendations include detailed procedures for automation of contract management processes. Among them:

Price Authorization Acknowledgements

- Manufacturers should use Price Authorization Acknowledgments in an EDI 845 or CSV file format matched to the 845 to send distributors information about pricing contracts. Each Price Authorization Acknowledgment transaction should represent one pricing contract agreement for one provider or group of providers per eligible buying group. Designation of a sold-to and ship-to pricing hierarchy is required to ensure that distributors set up pricing accurately for a group of providers. Using GS1 GLNs (Global Location Numbers) for provider identification is strongly recommended.

Manufacturers Price / Sales Catalogs

- Communication of changes to the Distributor Acquisition Cost (DAC) should not be sent as an EDI 845. Ideally, these are sent to distributors at least once a year in a separate EDI 832 or standard CSV file format.

End-User Sales Tracings (EDI 867 Product Transfer and Resale Report)

- Manufacturers must have the ability to process chargeback/rebate claims with standardized EDI 867 chargeback requests or by using a standard CSV import. The distributor price used in the chargeback calculation is the DAC set in effect at the time the provider order is accepted by the distributor for the products. Distributors should transmit chargeback claims to the manufacturer no later than 45 days after the sale; the chargeback claim should be processed by the manufacturer within 30 days of chargeback transmission. Using GS1 GLNs for provider identification is strongly recommended.

- Distributors should deliver their sales tracings to manufacturers as a Request for Chargeback/Rebate Payments daily, weekly, or minimally at least once a month.

Chargeback/Rebate Reconciliations (EDI 849 Response to Product Transfer Account Adjustment)

- Manufacturers send back a Chargeback Reconciliation with Resubmittal Responses via an EDI 849 or CSV file indicating which requested chargebacks/rebates they will pay. If the claim submitted has errors, the manufacturer will transmit a Chargeback Reconciliation with line item detail of the item(s) found to be in error. This Chargeback Reconciliation should include credit for the undisputed and adjusted credit amounts. It should also include the distributor’s original claim information, as well as the manufacturer’s response to this information.

Standard Identifiers Adoption

- Manufacturers and distributors should create cross-reference data maps for Contract Number, Product, Unit of Measure (UOM), and Customer ID with the ability to support industry standard identifiers for customer IDs and product IDs. Multiple data points provide multiple opportunities for trading partners

to ensure they are communicating about the same customer.

Contract Notification Industry Standards

Because so many errors result from parties having too little time to load pricing before it becomes active, this Contract Communications Standards paper also recommends standard notification timeframes for various contract types and changes. Using the foundation of providing 45 days’ notice to distributors prior to a contract’s effective date, pricing accuracy can improve for each of the following:

- New GPO contract activations

- GPO contract extensions

- GPO price tier changes

- New local vendor contracts

- Local extensions

- Local renewals

- New product additions to existing GPO or local contracts

- Price changes for products already on a contract

To realize the efficiencies and savings available from improvements in contract administration, distributors, manufacturers, GPOs, and providers are encouraged to adopt the standards explained in this paper and the accompanying template. It’s also important for trading partners to work proactively with GPOs, providing support and participation when completing GPO contract processes, as well as maintaining sales processes with disciplined controls for those who provide customers access to new pricing. Perhaps most important, sales staff must be trained and incentivized to complete contracts on time and within the framework of these standards.

Some of these recommendations require changes to information systems. Others require culture change. In particular, standards for timing of contract activation require all parties to begin negotiations early and finish on time, avoiding the temptation to allow negotiations to go until the last minute in hopes of greater concessions. It’s important to remember that GPOs need advance time for manufacturer and provider partners to review contracts, determine tiers, submit documents, and gain tier approvals for new and extended contracts to members—sometimes up to 45 days in addition and prior to the 45-day notification standard for distributors.

With adequate time, provider, distributor, GPO, and manufacturer systems are in sync, resulting in price matches, no chargeback/rebate errors or disputes, accurate GPO administrative fee payments, and significant cost savings for the healthcare system as a whole. While this Contract Communications Standards paper does not advocate best practices for aligning sales incentives to these standards, it is an area that deserves further discussion between contracting and sales departments, as well as with trading partners.

The Complexities of Contract Management in Healthcare

Pricing Overview

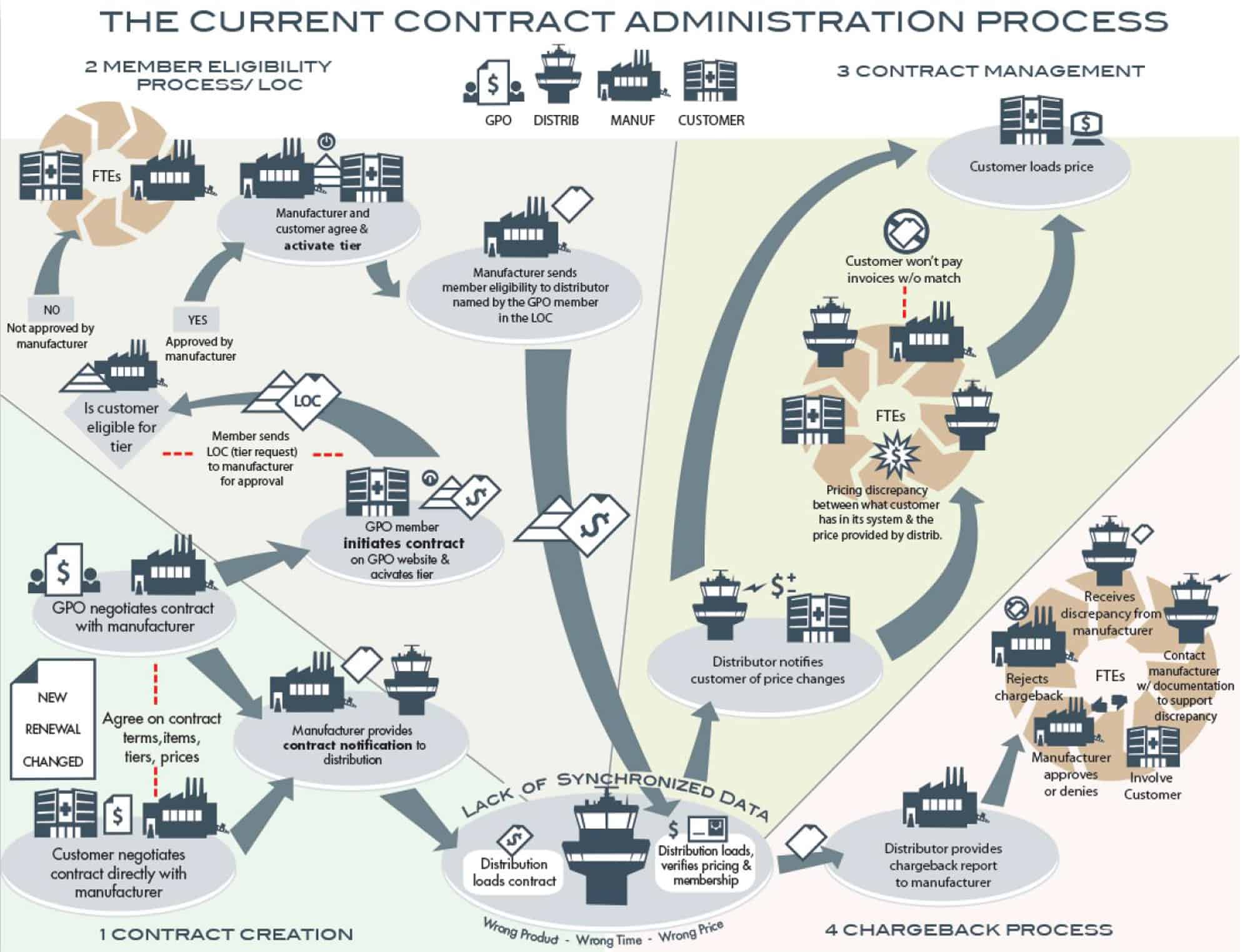

Pricing for healthcare products has evolved into a very complicated system. Most typically, group purchasing organizations (GPOs) negotiate with manufacturers to obtain contract prices for their healthcare provider members – thousands of health systems, hospitals, nursing homes, physician offices, and other facilities with tens of thousands of individual ship-to locations. Many of these products are then delivered to the facilities by distributors, who must invoice each provider at the agreed-upon contract pricing.

The process is multifaceted, and many factors add to its inherent complexity. For example:

- GPOs negotiate multiple pricing tiers to allow manufacturers to provide more attractive pricing to individual providers based on their purchasing volume, “class of trade,” or other factors.

- Some manufacturers create elaborate tier structures that are difficult to interpret and support, which can lengthen the time it takes for providers to select a tier.

- Manufacturers typically negotiate thousands of contracts per year across different GPOs and providers.

- Some providers belong to more than one GPO.

- Some providers also negotiate independent contract pricing agreements directly with manufacturers.

Ensuring providers are charged the correct contract price requires “price synchronization” between multiple entities: the manufacturer, the GPO, the distributor, and the provider. Complicating the challenge is the fact that even though price tier communications typically occur between the GPO and the manufacturer, the manufacturer must notify the distributor of negotiated provider price tiers once approved, but the task of invoicing these providers at the correct price usually belongs to the distributor.

Chargeback/Rebate Process Overview

Contract prices are usually lower than the distributor acquisition cost (DAC) or wholesaler acquisition cost (WAC).1 When a distributor buys a product from a manufacturer at DAC and sells the product to providers at a contract price lower than the DAC, a chargeback is required to keep the distributor whole. The chargeback is the difference between the manufacturer’s price to the distributor and the contract cost to the provider.

Distributors submit chargeback requests to manufacturers on a regular basis (daily, weekly, or monthly), and each request may contain thousands of line items for review. A typical mid-sized manufacturer will process hundreds of thousands of chargeback requests per year, and transfer hundreds of thousands of dollars per

year in chargeback payments.

Automation of Contract Management Processes

Industry-defined EDI transaction sets should be used by trading partners (in an EDI or standard CSV file format) to automate the end-to-end contract and chargeback management processes. However, these transaction sets have not been adopted widely and are not used in a consistent manner. In the section that follows, best practices are outlined for streamlining communication processes, standardizing transaction sets, and automating end-to-end processes which will lead to improved operating efficiencies across the healthcare supply chain.

Price Authorization Acknowledgment

Workgroup Member Tip

“Refresh copies should be available upon request. We find it works best if the change is received separately, with the nature of the change noted and a refresh copy attached. Even though the refreshed copy may not need to be imported, the copy of the contract on file is updated at all times, making searches easier and faster.”

Manufacturers should use Price Authorization Acknowledgments in an EDI 845 or standard CSV file format to send their authorized distributors information about pricing contracts for designated products to eligible facilities.

Manufacturers should send a full refresh of changes of their price authorization data to distributors detailing the reason for the change at the contract, buyer, and product level as defined below:

Change Type field at a Contract Header Level:

- Add – A new contract, renewal without changes, or extension of contract price authorization

- Change – An update to an existing contract, renewal with changes, or expiration of contract termination

- Delete/Expire – Termination of an inactive or active contract

Change Type at the Eligible Buyer Level:

- Add – Addition of an eligible buyer to a contract

- Change – Revisions to eligible buyer information (GLN, HIN, etc.) on the contract; a tier change, for example, would include expiring the eligible buyer on the current contract tier, and adding the eligible buyer to the new contract tier

- Delete/Expire – Elimination of an eligible buyer from an inactive or active contract

Change Type at the Product & UOM (unit of measure) Level:

- Add – Addition of a product to the contract

- Change – Modifications to the price, product ID, or dates for a product on the contract

- Delete – Removal of a product from the contract

This type of change is for a product and UOM update for a saleable UOM (case, box, pack, each, etc.). Manufacturers should include separate detail lines for every possible selling UOM in an EDI 832 or standard CSV file, but only one UOM type in an EDI 845 update.

Workgroup Member Tip

“Manufacturers should include all sellable units of measure. Many times only one UOM is sent and time-consuming conversions need to take place prior to the contract being loaded.”

Daily EDI transaction processing is recommended for Price Authorization Acknowledgments. For non-EDI business partners, weekly updates are recommended for changes. Complete “refreshes” are recommended at least twice a year, and also upon request. Any non-EDI changes received separately, indicating the nature of the change, help to expedite further research by contracting teams if processed in the correct sequence (any contract header level updates, then eligible buyer, then product and UOM). Documents processed out of order can result in incorrect pricing and increased instances of chargeback reconciliations.

The Price Authorization Acknowledgment transaction set should be used by a manufacturer to transmit specific data relative to the status of or changes to outstanding price authorizations. The Price Authorization Acknowledgment is sent by the manufacturer to the distributor to indicate a price authorization on a contract or a change to a price authorization on a contract. This notification should include all awarded products, all sellable units of measure, prices, and eligible providers for the awarded contract.

Industry Standards for Price Authorization Acknowledgement Processing & Communications

- Each Price Authorization Acknowledgment transaction represents one pricing contract agreement for one provider or group of providers per eligible buying group.

- Designation of a sold-to and ship-to pricing hierarchy is required to ensure distributors set up pricing accurately for a group of providers. The facility hierarchy should be defined by the provider and should be supported within all manufacturers’ and distributors’ systems, as well as the GPO membership roster. Any misalignment will result in pricing errors at a ship-to level. The exact definitions of “Facility Hierarchies”, rostering, and Letter of Commitment (LOC) activation processes require further industry research and investigation, and should include GLN and other provider cross referencing tools.

- The Price Authorization Acknowledgement should be used by the manufacturer during the time the contract is in effect to notify the appropriate distributors of any changes to an existing contract as changes occur.

- Manufacturers should utilize Add, Change, or Delete status fields to notify distributors of early contract expiration or removals from tiers due to provider or product additions to other contract pricing. While email communications with an explanation can help ensure timely processing, they can also add confusion and extra work due to their non-standardized format and the need to manually load changes. Regardless, an opportunity to put large data files (or EDI transmissions) into clear context often helps facilitate distributor processing, minimizing delays and errors.

- When a provider or product is removed from any contract based on an addition to a different contract, manufacturers should send two notifications: one for expiring from a contract, and the second for adding to a new contract to avoid confusion and any possible timing gaps.

- When distributors receive a Price Authorization Acknowledgment from a manufacturer, they should place the contract information in a Price Authorization Acknowledgment contract upload queue. Distributors should acknowledge receipt to the manufacturer, either through an EDI 997 notification or consistent communication format. After validating the data in the contract and addressing any missing information, distributors should run an update which creates, expires, and updates pricing contracts in their ERP system. During the update process, the system should create a pricing contract for each contract detail line item and then it should remove the expired line item from the Price Authorization Acknowledgment entry in the queue. Any line item for which the ERP system cannot create a pricing contract should remain in the queue in order for the distributor to view the contract detail and review the errors. Regardless of processing approach, errors need to be managed at the line level.

- Manufacturers should define business practices for GPO designations with distributors upfront to avoid any misunderstandings related to GPO eligibility, regardless of whether the manufacturer or distributor support multiple GPO affiliations or enforce the designation of one GPO. Distributors must honor and recognize these affiliation details as provided by manufacturers. Updating the distributors every 30 days, or upon request, would also help to remove most conflicts. When manufacturers do not require providers to designate only one GPO affiliation, provider transitions between GPOs will be handled by providers designating their primary GPO with their authorized distributor.

- If all GPO members are eligible to receive the contracted pricing, an EDI 845 or standard CSV equivalent communication is the preferred method for sending contract, price, and eligibility information to distributors to update the distributors’ membership eligibility directly from the GPO membership roster. Separate email communications or phone calls should only be used to discuss or clarify data already transmitted, rather than serving as primary information sources.

- Distributors should maintain a one-to-one relationship of material vendor IDs and manufacturer IDs. This can usually be accomplished by working with the manufacturer. Reducing the number of materials lists will streamline onboarding. Proliferation of the use of GTINs may also accelerate material vendor ID mapping efforts.

- For termination of an entire contract, sending only a Header is required. A contract Header termination would be used to process the expiration for all lines in the contract.

- For extensions, sending only a Header is required.

- For renewal of a contract, sending the Header and all lines is required to avoid any misinterpretation and to handle any pricing or other changes sent at the time of the renewal.

- Manufacturers should not reuse Contract Numbers, and distributors should not reuse Customer Numbers to avoid confusion or overlap of previously communicated information.

- When a distributor sells product to a provider, the distributor will invoice the provider at the prices set forth in their contract pricing agreement, plus any other markups or charges negotiated between the distributor and provider, as supplied by the manufacturer in the Price Authorization Acknowledgement.

See White Paper Definition Grid for recommended data elements and definitions for Price Authorization Acknowledgement (EDI 845).

Price/Sales Catalog

Any manufacturers’ changes to the Distributor Acquisition Cost (DAC) must be sent separately to distribu- tors, at least once a year. Data should be sent in the form of an EDI 832 or standard CSV file, but should not be sent as an EDI 845. Even minor DAC changes can lead to considerable time and energy wasted when trading partners dispute costs. As a result, manufacturers should review and confirm distributor-loaded DAC changes to avoid dispute periods lasting several weeks or months, especially when a product’s DAC has changed significantly.

The Price/Sales Catalog transaction set is used to provide the prices of goods or services in the form of a catalog. The Price/Sales Catalog is used by manufacturers to provide detailed product information to their supply chain trading partners. Recipients of 832 transactions can integrate the data directly into their business software. The information provided in a Price/Sales Catalog, such as minimum order quantities, case-pack quantities, etc., can then be used in the ordering process.

The Price/Sales Catalog generally includes two basic sets of information: product information and prices. More specifically, the Price/Sales Catalog transaction should include all of the following information:

- Seller name and contact information

- Terms of sale information, including discounts available

- Item identification and description

- Item physical details, including type of packaging

- Item pricing information, including minimum order quantity and case/pack quantity

- All saleable units of measure (case, box, each, etc.) for each item listed

Manufacturers should send a current snapshot of their price/sales catalog data or a future price/sales catalog to distributors. In the

Type field, identify one of the following:

- Current – Current snapshot of pricing information effective as of today’s date

- Future – Future-dated pricing that will be effective at a later date

Any current or future price sales catalog data should specify, where applicable, the exact timeframe for when list price start and end dates are effective.

Each update to this snapshot should also reflect one of the following:

- Add – A new contract, renewal without changes, or extension of goods or services pricing

- Change – An update to existing pricing, renewal with changes, or catalog expiration date

- Delete/Expire – Termination of an inactive or active catalog price

End-User Sales Tracing

Manufacturers report contract sales to GPOs and pay fees based upon distributor sales tracings. As a result, manufacturers must receive all contract and non-contract sales data from distributors, not just those involving chargebacks/rebates. The End-User Sales Tracings transaction set supports the trading partner practices relative to the reporting of sales. Normally, the End-User Sales Tracing Report transaction set will include the following information:

- Intra-company product transfer or consolidated distribution center (CDC) sale set by distributor

- Sales of product from one or more locations to an end customer

- Sales of product to an end customer where no chargeback claim is required

- Chargeback claims, which should include a claim ID/debit memo

- Returns from end customers to distributors; and

- Credits/rebills

The distributor’s ERP system tracks sales of products tied to pricing contracts and reports these sales when they send an End-User Sales Tracings file (via EDI 867 Product Transfer and Resale Report or CSV file) to the contracted manufacturers. The calculation for chargebacks is the difference between the DAC and the contracted price to the end customer. For example, if a widget’s DAC is $100 and the contract price (cost) is $80, the difference of $20 is the chargeback amount.

The End-User Sales Tracings data can be used to calculate chargeback claims, providing the distributor with an electronic mechanism to request reimbursement from the manufacturer. The End-User Sales Tracings chargeback transaction also can be used by the distributor to send an electronic credit memo (reverse chargeback) to the manufacturer in cases where a previously “charged-back” product has been returned by the eligible customer to the distributor or manufacturer.

Industry Standards for Submission of End-User Sales Tracings for Chargebacks/Rebates

- Because of varying system capabilities, manufacturers must have the ability to process chargeback claims with standardized EDI 867 chargeback requests or by using a standard CSV import.

- When purchasing items from a manufacturer, a distributor should enter purchase orders using the DAC.

- The distributor price used for purposes of a chargeback calculation is the DAC set in effect at the time the customer order is accepted by the distributor for the products, which may or may not be the same date a distributor creates an invoice for the customer.

- Chargebacks/rebates are authorized by a manufacturer when they designate a distributor as an authorized distributor for a facility and send contract pricing.

- Including the DAC in the End-User Sales Tracings based at the time of order by the customer results in fewer chargeback reconciliation issues.

- Distributors should transmit chargeback claims to the manufacturer no later than 45 days after the sale of the product to the eligible customer (the time the customer order is accepted by the distributor). The chargeback claim should be processed by the manufacturer within 30 days of the last transmission received for a chargeback period.

- The End-User Sales Tracings transaction set may be used by a distributor to report sales transactions to a manufacturer, and should include an accompanying claim ID/debit memo.

- The End-User Sales Tracings transaction is not to be used for the reporting of returns from the distributor to the manufacturer. However, it is used for the reporting of returns from the customer to the distributor which may result in a negative chargeback claim.

- Chargeback claim detail will be provided in the distributor’s sellable unit of measure (UOM) to the customer or provider. The UOM used between the distributor and the manufacturer could be at a higher level than the purchasing UOM utilized by a provider (for example, an each vs. a case).

- Distributors will calculate the chargeback based on the contract price and DAC in effect at the time of the customer’s original order date accepted by the distributor, which may or may not be the same date a distributor creates an invoice for the customer.

- Distributors may submit a negative chargeback any time a transaction is reversed or cancelled, including:

- when a distributor accepts a customer return on a contract item that was previously submitted for chargeback credit

- when an invoice is cancelled or credited because of an ordering error, billing error, or mis-shipment; or

- when an invoice is cancelled or credited resulting in the original transaction being reversed or cancelled (damages, credit/rebills, etc.).

Incorrect original billing should not generate new transactions, but rather get resolved in the original transaction.

- Distributors should ensure chargeback credits and returns have the same contract number and other field values (ship-to address, product code, etc.) to match and offset the original chargeback.

Distributors should deliver their sales tracings to manufacturers as a Request for Chargeback/Rebate Payments daily, weekly, or minimally at least once a month. When preparing the sales tracings file, the start and end date fields should be entered to ensure the invoices (for purchases and return credit memos) are included in the report. The recommended practice is sharing with manufacturers the detailed version of the report, which lists each transaction line by ship-to facility, product code, and UOM for which distributors are eligible for a chargeback. It is important to note that the chargeback summary report does not provide the necessary detail at the facility level to validate the chargeback claim and it should not be used.

See White Paper Definition Grid for recommended data elements and definitions for End-User Sales Tracing (EDI 867).

Chargeback/Rebate Reconciliation

Manufacturers send back a Chargeback Reconciliation with Resubmittal Response (via an EDI 849 Response to Product Transfer Account Adjustment or standard CSV file) to a chargeback claim received from the distributor through the End-User Sales Tracings. This response tells the distributor the chargeback amounts the manufacturer will pay. All Chargeback Reconciliations should be sent to distributors within 30 days of receiving sales data.

Workgroup Member Tip

“It is important to clarify that manufacturers should communicate both positive and negative errors in chargeback/rebate claims. Most manufacturers only notify the distributor if the claim is determined to be too high; if their records show that the distributor has not claimed all the chargebacks that they should, they don’t do anything. Eliminate the pass/fail mentality from chargeback claim processing, and evaluate and pay as adjudicated.”

Manufacturers then process chargeback claims and accept a distributor debit memo, send an electronic credit document, or send an ACH transfer to the distributor through the transmission of a Chargeback Reconciliation transaction set. This information is used by the manufacturer to reduce paperwork and expedite the chargeback payment process. Different manufacturers may choose different payment methods depending on internal processes and trading partner relationships.

The Chargeback Reconciliation with Resubmittal Response should detail any errors the manufacturer finds in the chargeback claims, whether they are deemed to be too high or too low.

If the chargeback claim submitted by the distributor is found to be without error, the manufacturer will transmit a chargeback payment or will internally clear the distributor’s debit for the claim. If the chargeback claim submitted by the distributor is found to include errors, the manufacturer will transmit a Chargeback Reconciliation with line item detail of the item(s) found to be in error in the original chargeback claim. This Chargeback Reconciliation should include credit for the undisputed and adjusted credit amounts, along with any line item denied for credit. Only items found in error—adjusted or denied—should be transmitted back to the distributor with a reject reason code (see examples below). Adjusted credits for under-submitted chargebacks should be included with reason codes for a distributor to correct its system and the pricing to the provider customer.

Adopting standard codes that explain chargeback rejections increases efficiency and expedites dispute resolution between trading partners. The Healthcare Distribution Alliance has developed and implemented a list of standard reject codes for the pharmaceuticals segment; many of these are equally applicable to other healthcare segments.

Reject Reason Code Name

#

Code

Name

Description

Required?

Priority

1

AA

Contract Number Not Provided By Rebator (Contract Number Missing)

This code would only be used if a distributor requests a sum of money but does not have a contract number associated with the request.

Required

Primary

2

BB

Contract Number Referenced Incorrect / Unable To Identify Contract Submitted

Contract number supplied does not match any valid number in manufacturer file. This code is used when a distributor issues its own contract number rather than supply a GPO/IDN or manufacturer contract number. It may also be used when a contract number provided by a distributor cannot be validated against a manufacturer, GPO/IDN, or Group Special Pricing contract.

Required

Primary

3

CC

Contract Referenced Has Expired

Invoice date after contract expiration date. This code is used when the contract submitted has expired, was replaced with a new contract number (not a revision number), and the claim is applied against the old contract and pricing.

Required

Primary

4

DD

Contract Not Yet In Force Or In Effect At Time Of Sale

Invoice date occurred before contract start date. This code is used when a contract has been replaced by a new contract number that has not yet gone into effect. The rebate should be processed against the contract that was in effect at the time of the sale date.

Required

Primary

5

KK

Product Not Covered On Contract

Product for this chargeback not covered on this contract. Used when the item in question is not on the contract referenced. Or when the item is included in the “Group” portfolio but not on the contract requested (e.g., a distributor supplies contract 123XXX1 for an item that is part of the group portfolio but item is on contract 123XXX2).

Required

Primary

6

LL

Product Expired From Contract Referenced

This is code is used when a product is dropped from contract before invoice date.

Required

Primary

7

MM

Product Not Yet Eligible

Invoice date precedes date of inclusion of product on this contract.

Optional

Supplemental

8

OO

Distributor Not Covered / Authorized To Distribute By GPO / IDN

Manufacturer has no record of inclusion of this distributor on this contract. National Accounts should be contacted to verify if the distributor can be added as a rebator prior to using this code.

Required

Primary

9

PP

Distributor Authorization Expired

Distributor dropped from this contract; expired by GPO/IDN or manufacturer.

Optional

Supplemental

10

QQ

Distributor Not Yet Eligible

Invoice date precedes date of inclusion of this distributor on this contract. The distributor authorization by GPO/IDN or manufacturer is not in effect on claim date.

Optional

Supplemental

11

FF

Customer Not Covered On Contract / ID Does Not Exist In GPO Roster

Manufacturer has no record of this customer location or ID on the submitted contract. This code is used when a distributor requests a rebate for a facility that is not listed on the current “GPO/IDN or Group Special Pricing Membership” contract.

Required

Primary

12

GG

Customer GPO/IDN Membership Expired

Customer dropped from contract before invoice date. This code is used when a facility is no longer part of the GPO/IDN or Group Special Pricing for which the rebate request was submitted. Please verify the latest uploaded membership prior to using this code.

Required

Primary

13

HH

Customer Not Yet Eligible For Contract Referenced

Invoice or claim date precedes inclusion of customer on contract. This code is used when a distributor requests a rebate for a facility that is not listed on the current “GPO Membership”.

Optional

Supplemental

14

II

Customer Number, Referenced ID, Or Address Missing

This code is used when a customer’s number, referenced ID, or name/address required to identify customer is missing.

Required

Primary

15

JJ

Customer Number, Referenced ID, Or Address Invalid

This code is used when a manufacturer is unable to validate a customer’s number, referenced ID, or the customer’s name/ address is invalid.

Required

Primary

16

A2

Line Item Too Old

Invoice date ineligible for claim submission, under terms predetermined by manufacturer and distributor.

Required

Primary

17

CT

Unauthorized Class of Trade

Invalid end customer Class of Trade. Examples: End customer is Distributor or Reseller; or non-Government customer for Government Contract; or Retail customer for GPO contract.

Optional

Primary

18

EE

Invoice Date Missing Or Invalid

Invoice date for chargeback claim not supplied or invalid.

Required

Primary

19

RI

Invalid Resubmit Number

Resubmit number does not match denial debit memo, invoice number, or most recent resubmit number assigned.

Optional

Supplemental

20

XD

Distributor Invalid / ID Does Not Exist

Distributor is not eligible to participate in chargeback program. Distributor’s ID is invalid or does not exist in manufacturer’s authorization file. Only used when the distributor is the end-customer.

Conditionally Required

Primary (when used)

21

YY

Duplicate Chargeback Request/Transaction

Manufacturer has record of previous claim by distributor on this invoice. This code is used when the end-user / invoice / item / quantity and date are the same for both lines.

Required

Primary

22

A3

Quantity Invalid - Free Goods

No record of charge for distributor’s purchase of item referenced in claim.

Optional

Supplemental

23

A5

Minimum Order Quantity Not Met

Minimum order charges not applicable to traced sales/rebate calculation. Used when a distributor requests a sum of money for a minimum order charge, or contract terms outline minimum quantity requirements for item associated with claim.

Optional

Supplemental

24

PB

Payback - Distributor (No Rebate Dollars Calculated)

This code is used for paybacks of previous chargeback/rebate discrepancy balances from Distributor to Manufacturer.

Optional

Supplemental

25

TA

Tolerance Adjustment

This code is used when the rebate issued is greater than or less than the rebate requested (either due to rounding or a lack of information to confirm if it is an acquisition cost error or a contract cost error).

Optional

Supplemental

26

NN

Product Number Missing Or Invalid For Manufacturer

Product number not submitted or unable to identify. This code would only be used if a distributor requests a sum of money and supplies a contract number, but either supplies an invalid number or fails to supply an item number with the request.

Required

Primary

27

RR

Reported Quantity/Selling UOM Invalid Or Not Supplied

Quantity on invoice invalid or not supplied as required. This code is used when a distributor supplies any unit of measure other than the selling standard, if unable to determine what the cross-reference unit of measure should be.

Required

Primary

28

XP

Incorrect Price For UOM

Used when the actual unit of measure submitted on the chargeback (e.g., EA) does not correlate with what the manufacturer has listed for the EA price of that item.

Required

Supplemental

29

SS

Contract Price Missing Or Incorrect

Contract unit price not supplied or incorrect. This code is used when the extended contract price divided by the quantity does not match the unit contract price.

Required

Supplemental

30

UU

Unit Cost Missing Or Incorrect / Acquisition Price Reported Incorrect

Unit cost missing or incorrect. This code is used when the extended sold to end-user price divided by the quantity does not match the price to the distributor.

Required

Supplemental

31

ID

Price List Date Invalid

This code is used when a distributor’s reported purchasing price/cost is not in effect on invoice date.

Optional

Supplemental

32

NR

No Rebate/Zero Dollar Rebate

Distributor acquisition price equal to or less than contract price. This code is used when the contract price is higher than the acquisition price.

Required

Supplemental

33

QP

Quantity And Price Reported Are Negative

Used when item quantity and price reported are negative.

Optional

Supplemental

34

TT

Contract Price Inserted Or Corrected

Contract price was missing or incorrect, but was adjusted to be correct. This code is used when the extended contract price divided by the quantity does not match the unit contract price.

Optional

Supplemental

35

VV

Unit Cost Inserted Or Corrected

Unit cost was missing or incorrect, but was adjusted to be correct. This code is used when the extended sold to end-user price divided by the quantity does not match the price to the distributor.

Optional

Supplemental

Classifying errors provides useful insight into trading partner inefficiencies. By applying all or some of these codes to related errors in a consistent manner, a distributor or manufacturer may be able to use this information to determine internal contracting process improvements or proper responses to Chargeback Reconciliations.

Distributors should respond promptly to any disputed Chargeback Reconciliations. Chargeback resubmittal processes can vary depending on the size or capabilities of the distributor, but some acknowledgment should be made within 30 days of receipt. If no chargeback claim resolution can be reached after a resubmittal response, further investigation and multi-party correspondence involving the GPO is required. Depending on the size and nature of the manufacturer-distributor relationship, partners should address the distributor’s response using an appropriate cadence of calls in order to avoid chargeback disputes remaining open or unresolved for extended periods of time.

Credit and debit memos issued by manufacturers should include:

- Distributor division

- Claim number

- Amount; and

- Date of the transaction

Minimally, the month and year of the transactions credits should be noted. For debit memos, line item detail information should not be included unless there is a discrepancy in the chargeback data. For credit memos, manufacturers should provide line item detail with invoice number and date to allow distributors to apply the credit to the appropriate open receivable. Chargeback discrepancies should include a discrepancy reason code and the original transaction detail.

Standard Identifiers Adoption

Standard product and location identifiers allow companies and trading partners to use a common language to identify items and locations in the supply chain. This common language allows companies to then identify, capture, and share supply chain information globally. Most importantly, standards enable collaboration with trading partners, an optimized supply chain, and more efficient business processes that reduce human error and cut costs.

Manufacturers and distributors should create cross-reference data maps for Contract Number, Product, Unit of Measure (UOM), and Customer ID with the ability to support industry standard identifiers for customer IDs – GLN, HIN, DEA, Wholesaler Customer ID, Group (GPO) customer ID, the provider’s internal customer ID – and product IDs such as GTIN, NDC, UPN, and ICCBBA identifiers.

Most healthcare suppliers and providers believe adopting and using GS1 standards like the GLN (Global Location Number) and GTIN (Global Trade Item Number) provide the best opportunity for the industry to standardize location and product identification. Giving providers ownership of enumerating their major locations using GLNs down to their ship-to levels (as opposed to their deliver-to locations, like a facility wing or storage closet) is important for maintaining accurate data. Trading partners will then be able to use those location identifiers in their communications, syncing up processes and eliminating duplicate provider identifiers or numbers.

This standard will only succeed if the industry embraces and adopts it as a whole. The FDA’s Unique Device Identification (UDI) rule is already driving manufacturer compliance on acceptable product identification standards, but distributors and manufacturers can both benefit by also transacting with providers and trading partners using one standard location identifier.

While HIDA strongly encourages GS1 standards adoption, its current recommendation is to use multiple identifiers – GLN, GPO number, etc. – in contract communications. Multiple data points provide multiple opportunities for trading partners to ensure they are communicating about the same customer. GPOs can proactively contribute to successful standards adoption and practices by regularly providing updated, cleansed member identifiers to manufacturers and distributors included on the GPO members listing (roster).

Standardized Timing for Contract Activation

Workgroup Member Tip

“Buy a desk calendar if you have to. It sounds simple, but trading partners should always know and be prepared for when contracts are going to expire.”

The following section outlines disciplined contract notification timing standards that can help drive pricing accuracy. Providing distributors a minimum of 45 days’ notice of effective provider pricing, regardless of contract type or change, can help eliminate contract negotiation delays, errors, and backlogs. Transacting via standardized EDI or CSV formats and using standard provider identifiers such as GLNs can also accelerate the healthcare contracting process.

The expectation of pricing accuracy begins as soon as the contract becomes effective. Providers, manufacturers, group purchasing organizations (GPOs), and distributors are all impacted by problems caused by inconsistent implementation of new contracts (whether GPO or Local), GPO tier activations/changes, and expiring/extending contracts. These problems manifest themselves in costly rework due to increasing occurrences of:

- Pricing variations (A/R increases, short pays)

- Backdated contract pricing

- Chargeback/rebate denials (credits, rebills, disputes handling)

In 2014, HIDA’s Contract Administration Workgroup published recommended timeline standards for different contract types, yet the industry still lacks agreement on certain timeline definitions and start dates. Short time frames and rushed pricing through supply chain partner systems often exacerbate these problems because of work backlogs/queues, delayed contract negotiation strategies, and improper expectations presented to the provider.

Establishing a standardized time frame for contract activations is still a key to eliminating redundant effort and costs. Using the foundation of 45 days’ notice to distributors prior to a contract’s effective date, HIDA’s Contract Administration Workgroup has identified a single, specific industry standard to help clarify timeline initiation dates, regardless of contract type. This synchronization of notification requirements provides distributors 15 days to load pricing and communicate to providers, and providers 30 days to load pricing, regardless of contract type or change.

The objectives are to:

- Improve visibility

- Create predictability

- Drive for accuracy

- Encourage proactivity

- Leverage common expectations:

- Accurate pricing

- Correct price tier placement

- Eliminated or minimized rework

- Timely availability of new products

- Accurate administrative fees (if applicable)

Following other contract communications standards of transacting via standardized EDI and using standard customer identifiers can likely shorten manufacturer-distributor or distributor-provider approval timelines. Regardless of contract type, by standardizing on 45 days’ notice to distributors prior to a contract effective date, trading partners can actively help drive consistency and improve pricing accuracy.

Contract Types

There are several different types of contracts and changes, defined below, to which timelines can be applied. All must include the standard of 45 days’ distributor notice prior to a contract effective date. By following disciplined and adequate notification timing standards, provider, distributor, and manufacturer systems are in sync, resulting in no price variance (A/R issues and short pays) and no chargeback errors/ disputes.

GPO Contracts

- New GPO Award – GPO goes through formal process to award manufacturer a contract position; uses a new GPO award identifier, which is usually the GPO contract number as assigned by the GPO

- GPO Extension – Existing GPO award is extended; uses existing GPO award identifier

- GPO Price Tier Change – Provider pricing changes on an existing GPO award by moving it to a different price tier

A significant amount of industry price change notifications, errors, and rework occurs as a result of provider movements across GPO price tiers. As a result, GPOs and manufacturers must follow the proactive advance measures outlined in the following section in order to meet the 45-day notice standard for distributors.

These advance measures could take up to several weeks prior to the 45-day distributor notification, as GPOs need time for manufacturer and provider partners to review contracts, determine tiers, submit documents, and gain tier approvals for the above contract types. To avoid further disputes, it’s imperative that local sales reps follow disciplined pricing access procedures for provider customers to avoid disputes. With adequate time, provider, distributor, and manufacturer systems are in sync, resulting in no price variance, no chargeback errors/disputes, and accurate GPO administrative fee payments.

Local Contracts

- New Local Vendor Contract – A manufacturer agreement, usually with a specific distributor for special distributor acquisition costs to support special provider-specific pricing; uses a unique contract identifier, usually a tier number assigned by the manufacturer

- New Local Member Contract – A manufacturer agreement with a specific provider for provider-specific pricing

- Local Extension – Existing local contract is extended; uses existing contract identifier

- Local Renewal – Existing local contract is extended with price modifications; uses a new contract identifier

Contract Changes

- New Product Addition – New products are added to GPO or local contracts with agreed-to pricing; uses existing contract identifier

- Price Changes – Products on a contract have prices that are increased or decreased; uses existing contract identifier

Workgroup Member Tip

“Distributors’ customer account data needs to be used by providers during collaborative discussions with suppliers and GPOs to ensure all locations are validated. Locations can be inadvertently left off of contracts in the absence of this information, leading to future billing and chargeback issues.”

Contract Notification Industry Standards

GPOs

- New GPO Contract Awards – Sufficient time, often as much as 45 additional days prior to the distributor 45-day advance notification date, is allotted by the GPO for manufacturers to assign providers to the appropriate price tier—through pre-slotting or through a Letter of Commitment (LOC) process.

- GPO Price Tier Activation/Changes – GPOs, manufacturers, and providers proactively collaborate on LOCs, compliance issues, and anything else impacting tiers. These collaborations should occur up to 30 days prior to the distributor notification date.

Manufacturers

- New GPO Contract Awards – Manufacturers use new contract numbers, typically generated by GPOs. They also need to communicate to providers their pre-slotting ahead of time to ensure a distributor’s price change notice is not the first time providers are made aware of these changes. Manufacturers also use conference calls with distributors to share informational aspects of the contract that will assist with provider awareness. Manufacturers provide distributors 45 days’ advance notice of a new award’s initiation date to communicate new pricing to providers. Manufacturers also need to support a contracting process in collaboration with GPOs to allow ample time for tier placement and provider communications following the GPO award and in support of the 45-day notice for distributors.

- Extending a Contract/Award (with or without Changes) – Manufacturers proactively notify distributors 45 days prior to effective date so the distributors and providers do not have to guess the manufacturers’ intention. Manufacturers also need to support a contracting process in collaboration with GPOs to allow ample time for tier placement and provider communications following the GPO contract/award extension and in support of the 45-day notice for distributors.

- GPO Price Tier Activation/Changes – Manufacturers should be the first to communicate with providers on any price tier change, not the distributor. Manufacturers provide distributors 45 days’ advance notice of a tier activation/change’s effective date to communicate new tier pricing to providers.

- Replacing a Terminating GPO Award with a Courtesy Contract – Manufacturers notify distributors 45 days prior to effective date.

- New Local Vendor Contracts – Manufacturers utilize new contract numbers, assigned by the manufacturer, and provide distributors 45 days’ advance notice of a contract effective date to communicate new local pricing to providers.

- For Expiring a Contract/Award – Manufacturers start early—90 to 120 days before a contract expires—and notify distributors 45 days prior to expiration. Communication is crucial in these instances since contract termination notices often will not be sent automatically if contract end dates have not changed from the original agreement.

Distributors

- New GPO Contract Awards – Distributors provide customers 30 days’ advance notice of a new award initiation date to validate, challenge, and load pricing to internal systems.

- GPO Price Tier Activation/Changes – Distributors provide customers 30 days to validate, challenge, and load pricing to internal system, although these time periods are not always part of contractual terms entered into between manufacturers and GPOs.

- Extending a Contract/Award (with or without Changes) – Distributors notify providers 30 days prior to expiration date.

- Replacing a Terminating GPO Award with a Courtesy Contract – Distributors notify providers 30 days prior to expiration date.

- Local Vendor Contracts – Distributors provide customers 30 days to validate, challenge, and load pricing to internal system.

- Expiring a Contract/Award – Distributors notify providers and manufacturers 30 days prior to expiration.

Contract Initiations

In each of the following examples, consistently using certain days or dates of the month for contract activations can help reduce complexity or errors. Sample days and dates are provided below as example contractual terms for GPO agreements. The ability to provide pricing data quickly via an EDI 845 or standard CSV equivalent would also help to reduce concerns regarding data frequency and allow for increased next-day or possibly same-day processing.

- New GPO Contract Awards – Contracts are activated on the first day of a month and end on the last day of a month.

- GPO Price Tier Activation/Changes – New price tiers start on the 1st or 15th of a month and end on the last day of a month.

- New Local Vendor Contracts – Contracts start on the 1st or 15th of a month and end on the last day of a month.

The Big Picture

It’s important to recognize all industry partners involved in the contract timing process and their challenges:

- GPOs: Responsible to providers (GPO members) to achieve cost savings by negotiating contracts on their behalf. These contracts must be made available on a timely basis to manufacturers so they can notify distributors, who must implement and communicate terms to their customers. GPOs may need up to 45 additional days prior to the distributor 45-day advance notification date to allow manufacturer and provider partners to review contracts, determine tiers, submit documents, and gain tier approvals for new and extended member contracts.

- Manufacturers: Negotiate with GPOs to create a contract—usually with multiple tiers—and are responsible for communicating the contract terms and tier eligibility to providers. Manufacturers may also contract directly with providers. They are then responsible for communicating the availability and pricing details of the negotiated contract to distributors at least 45 days prior to a contract effective date. Manufacturers must report contract sales data each month to GPOs, which is dependent on distributors reporting this data in a timely manner, usually in conjunction with distributor chargeback filings.

- Distributors: Central to all information shared between GPOs, manufactures, and providers. Need to receive and understand the availability and pricing details of negotiated contracts between GPOs and manufacturers at least 45 days in advance of a contract effective date. They must also be informed by the manufacturer of tier eligibility and communicate correct contract prices to the provider at least 30 days before a contract’s effective date. Distributors must load and activate the pricing received from the manufacturer and correct pricing where the manufacturer has identified inaccuracies.

- Customers (Healthcare Providers): Purchase manufacturers’ products on contract as negotiated by their GPO, manufacturer, and/or distributor. Providers must follow their GPO- and/or supplier-negotiated LOC processes to ensure their distributor is using the correct contract price, which may be based upon the tier to which the provider is eligible for GPO agreements. This adherence also ensures provider locations are properly listed in a GPO’s roster and included on LOCs to provide access to pricing. Providers may also negotiate pricing directly with manufacturers, which need to follow the above process.

Regardless of new contract type or change, manufacturers can help improve pricing accuracy for providers by giving distributors at least 45 days’ notice prior to a contract effective date. Following the other Contract Communications Standards of transacting via standardized EDI or CSV formats, as well as using standard customer identifiers, can shorten the time needed by manufacturers and distributors to load pricing, tier providers, and communicate with providers. In addition, it should also shorten the time providers need to review and verify GPO price tiers. It is crucial that sales staff be held accountable for allowing providers correct access to approved and negotiated price tiers. The timeline standards included in this paper aim to account for all trading partners in the healthcare supply chain and provide sufficient notification time needed to achieve pricing accuracy.

Summary

Adopting the standard practices explained in this paper and the accompanying template is an important first step toward realizing the efficiencies and savings available from improvements in contract administration.

Most of these changes are not easy. Some require reprogramming of information systems. Many require changes to company policies and processes.

The timing recommendations require not only process change but also culture change. All parties must commit to beginning negotiations early and finishing on time, avoiding the temptation to allow negotiations to go until the last minute in hopes of greater concessions. Perhaps most importantly, sales staff must be trained and incentivized to complete contracts earlier in order to minimize the need for back-dated access to approved provider pricing. Some amount of back-dating may be inevitable due to rational commercial needs, but using delays to seek an advantage is to be discouraged by all industry partners.

The many manufacturers, distributors, group purchasing organizations, and industry partners who participated in the development of this Contract Communications Standards white paper believe these efforts and investments will pay off. With standard processes and adequate time, provider, distributor, GPO, and manufacturer systems are in sync, resulting in price matches, no chargeback errors/disputes, accurate GPO administrative fee payments, and significant cost savings for the healthcare system.

For more pricing accuracy resources, including an Excel template that replicates 845 EDI transaction sets, visit hida.org/pricingaccuracy.

Appendices

The HIDA Contract Creation Working Team produced definitions to assist all healthcare industry contract trading partners in the understanding and efficient processing of 845 and 867 EDI transaction sets (or their standard CSV counterparts).

The appendices contain the following:

Click here to download a free Excel template that replicates 845 EDI transaction sets.

Definitions & Data Elements

The following definitions are meant to provide all healthcare contracting trading partners a better understanding of the terms and data elements used to process 845 and 867 EDI transaction sets or their CSV conversions.

845 & 867

- Contract Unit Price (Cost): The special cost of the specific product negotiated by the vendor and the buyer group/end user. Often referred to as contract price but technically is the contract cost upon which the contract price is determined after the distribution mark-up is applied. For purposes of the communication between manufacturers and distributors the contract price will reference the cost portion only, including the definition used for Rebate (Chargeback) calculations.

845 Category: Product

- GTIN: GS1 Global Trade Item Number (GTIN) that can be used by a company to uniquely identify all of its trade items. GS1 defines trade items as products or services that are priced, ordered or invoiced at any point in the supply chain

845 Category: Product

- Item Description: Usually created by the vendor and describes the item

845 Category: Product

- Unit of Measure: Standard unit or system of units, by means of which a quantity is accounted for and expressed. Can be stock, purchasing or selling unit of measure, e.g. piece, each, box, case

845 Category: Product

- VN Item ID / MF Item ID: Manufacturer-assigned number for identifying its products

845 Category: Product

845 Only

- Material Effective Date: The effective date of the material on the contract

845 Category: Product

- Material Expiration Date: The expiration date of the material on the contract

845 Category: Product

- Packaging: Standard unit or system of units, by means of which a material or item is packaged

845 Category: Product

867 Only

- DAC (Distributor Acquisition Cost): The product cost invoiced to the distributor by the vendor

845 Category: Product

- DC / Branch #: Distributor Branch ID Number

- DC / Branch Name: Distributor Branch Name

- Distributor: Selected by the member by way of the LOC process to supply the member products on the contract and then use the chargeback process to fund margin pursuant to the contract from the vendor after the sale to the member by the distributor

- Distributor Item ID: Distributor assigned number for identifying its products

- Invoice Date: Date the end customer was issued their billing statement

- Invoice Line: Should be sent by distributors on chargebacks to reduce false positive errors

- Invoice Number: Distributor invoice number for sale to eligible member

- Pricing Date: Date the end customers order was processed for billing

- Quantity: Quantity SO

- Rebate $ Extended: Total refund requested. The difference between DAC and the contract price for a product on a contract

- Rebate $ Per Unit: Refund requested. The difference between DAC and the contract price for a product on a contract

- Rebate Period & Debit Memo/Ref. #: Should be sent by distributors on chargebacks and used in AP/AR transactions to ensure tie out

- Sales Type Code: Invoice transaction description (standard stock sale, return, adjustment, etc.)

- Vendor: The entity that has control over contract pricing and chargebacks and has negotiated a contract with a buyer group: a GPO or other affiliations representing members who can utilize the contract, or with an end-user customer using a local vendor contract

- Vendor Name: Vendor name

Definition Only

- 845 EDI transaction set: Used by vendors (manufacturers) to send contracts to distributors. Bid award / contract notification / Price Authorization Acknowledgement or status. Identifies contract information on individual or group contracts, including eligible customers, products, and pricing

- 867 EDI transaction set: Used by distributors to send chargebacks (rebates) to vendors (manufacturers) for the distributors to be reimbursed from the vendors for the difference between DAC and contract cost. End-User Sales (sent from a distributor) or Product Transfer and Resale

- Chargeback: The difference between DAC and the contract price for a product on a contract

- Contract: An agreement between a vendor and a buyer group which members can utilize or an LVC

- Contract Tier: Various levels of prices for products on a contract accessed by members by reaching or maintaining contract requirements

- CSV: Character-separated values that stores tabular data (numbers and text) in plain-text form. Easily created from Microsoft Excel, Notepad, Google Spreadsheet and other applications

- Customer: The healthcare provider or end user that is charged contract cost plus, if applicable, ‘distributor markup’. An eligible member of a GPO is a customer

- Distributor Markup: The percentage or amount the distributor will add to contract cost to create the sell price to the eligible member or customer

- EDI: Electronic data interchange, an electronic communication system that provides standards for exchanging data via any electronic means

- GPO: Group purchasing organization, the most prevalent kind of ‘buyer group’

- GS1 Standards: GS1 is dedicated to the design and implementation of global standards and solutions, to improve the efficiency and visibility of supply and demand chains globally and across sectors. The GS1 system of standards is the most widely used supply chain standard

- Item Number: Usually assigned by the vendor and identifies the specific item

- LOC: The abbreviation for ‘letter of commitment’ that a member would initiate on a contract asking the vendor to approve a tier or other price that the member would receive

- Local Vendor Contract (LVC): A vendor contract not associated with a buyer group

- Member: The entity that is affiliated with a buyer group

- Rebate: See ‘Chargeback’

- WAC: Wholesaler acquisition cost, same as DAC except WAC is the product cost invoiced to the wholesaler by the vendor

The Current Contract Administration Process

About HIDA

The Health Industry Distributors Association (HIDA) is the premier trade association representing medical products distribution. HIDA members offer services that increase the efficiency of the nation’s hospitals, nursing homes, physician practices, and other healthcare providers. Member companies range from independent businesses serving local communities, to international Fortune 500 companies.

Since 1902, HIDA has provided leadership in the healthcare distribution industry. HIDA also works closely with manufacturers, GPOs, and service providers through the HIDA Educational Foundation. This outreach serves to build strong manufacturer/distributor relationships as well as to communicate the value of distribution in the healthcare supply chain.

Advocacy

HIDA’s Government Affairs team offers insight and advocacy for current issues impacting member distributors and their customers, healthcare providers. Resources include legislative and regulatory summaries, reimbursement updates, news alerts, advocacy letters, and issue-specific resource centers.

Research & Analytics

HIDA Research & Analytics (HRA) services support member distributors and manufacturers by developing industry-specific market research publications. HRA resources provide customized decision support tools equipping companies to better meet market challenges.

Networking & Events

HIDA events bring together manufacturers and distributors throughout the medical products marketplace, providing valuable networking opportunities and education programs that together form a foundation for success. Events include the Streamlining Healthcare Conference, Executive Conference, Contract Administration Conference, Washington Summit, and Market Conferences.

Education | Accredited In Medical Sales (AMS) Training

HIDA and the HIDA Educational Foundation are dedicated to providing the medical products industry with quality education to improve bottom-line performance and increase overall industry knowledge. HIDA offers comprehensive training for sales representatives, as well as industry accreditation designed to increase performance, retention, and profitability.

Industry Initiatives

HIDA’s Pricing Accuracy Initiative is a key example of the association’s efforts to educate stakeholders on critical issues. Others include:

Contributor Recognition

This paper continues the work of defining industry standards that improve pricing alignment between distributors, manufacturers, group purchasing organizations (GPOs), and providers. Many volunteers contributed their time and expertise to develop these standards. Among the many companies that have contributed to this effort:

Special recognition also goes to the Healthcare Distribution Alliance (HDA) for previously identifying some of the best practices included in this document.

HIDA’s Improving Pricing Accuracy: Contract Communications Standards for the Healthcare Supply Chain is published by the Health Industry Distributors Association, Copyright 2020. All rights reserved. For more information about HIDA membership, products, or services, please contact HIDA at 703-549-4432 or visit HIDA.org.

Last reviewed October 2023. Published May 2020.

Footnotes

- Because the differences between DAC and WAC are subtle, for this paper, the term DAC will be used. Go back to section