Financial concerns continue to be a leading challenge for physician

practices. Thirty-five percent of physician office managers list

reimbursement as a top concern, while a sizeable portion identify

collecting co-payment and deductibles (30 percent) and lowering

operating costs (21 percent) as priorities. These needs are shaping

provider priorities, and inform decisions physician practices make.

HIDA’s provider survey The Evolving Physician Office: Revenue Pressure Determines Practice contains

an in-depth look at the financial pressures these providers face, as

well as the steps physicians are taking to address them. These are just a

few insights from the report.

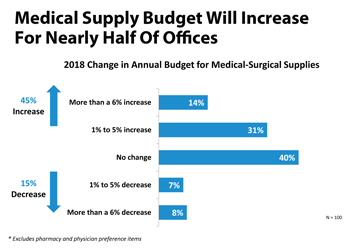

Aging population drives up medical supply budgets

Forty-five percent of physician offices plan to spend more on

medical supplies, with 14 percent planning to increase their budgets by

more than 6 percent. Key drivers of this trend include greater patient

volume due to an aging population, higher costs, and a greater incidence

of chronic conditions.

Physicians increase on-site offerings

Thirty-five percent of physician offices provide at least

moderately complex clinical lab testing on site, an eight percentage

point increase from 2016. Among the providers that do not provide

on-site lab testing, 35 percent said that regulations are too

burdensome, and 27 percent said reimbursement is not adequate.

Providers invest in technology, staff to strengthen reimbursements

Survey respondents discussed a number of investments they plan

to make to improve their revenue cycle. Examples of this include credit

and debit card systems, so patients can be charged at the time of

service, and new technology to determine what a patient’s deductible

will be at the time of service. One practice manager added that they are

training front desk personnel on professional collection strategies.

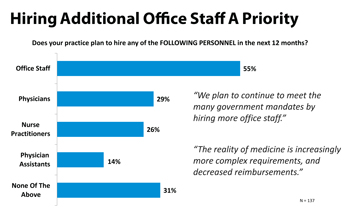

Staffing remains a priority

Staffing remains a key priority for physician office practices,

although the majority (55 percent) are focused on hiring non-clinical

office staff. Less than one-third (29 percent) plan to hire physicians,

while 26 percent plan to hire nurse practitioners, and 14 percent are

recruiting physician assistants.

Larger physician practices tend to employ more non-physician clinical

staff, such as nurse practitioners and physician assistants. Practices

with 11 or more physicians have, on average, five nurse practitioners

and two physician assistants. By comparison, offices with two to five

physicians employ a single physician assistant and two nurse

practitioners.

These are just some of the insights contained in the provider survey.

For more information, or to learn about HIDA’s primary research, visit www.HIDA.org/ProviderSurvey.

From: http://www.repertoiremag.com/rising-costs-revenue-pressures-shape-physician-practice-priorities.html