Experts See Lab Volume Growth, Despite Shrinking Reimbursements

There’s been a lot of talk lately about how reimbursement cuts under

the Protecting Access to Medicare Act of 2014 (PAMA) will impact the

laboratory and diagnostics market. While we expect these cuts to have an

impact on providers, both leading diagnostic experts and HIDA research

suggest that overall testing volume may grow in coming years.

Consumers and payers are looking for ways to reduce long-term health

spending, and diagnostics offer multiple opportunities to achieve this

goal. Speakers at HIDA’s recent Laboratory & Diagnostics Market

Conference cited numerous examples of such opportunities, including

helping physicians appropriately use HbA1C testing to reduce

complications and hospitalizations for diabetic patients, testing for

medication adherence, and testing for opioid use.

Findings from HIDA’s 2017 Laboratory Care Market Survey indicate

testing volume will likely grow. The majority of respondents forecast

some form of growth, with 56 percent anticipating volumes to grow by one

to five percent, and 15 percent of expecting even higher growth.

Despite expected volume gains, lower reimbursements are constraining lab

spending and investment.

Investment slows, but providers still plan for growth

Most diagnostic providers still have plans to invest in new or existing

capital equipment, though reimbursement cuts are clearly impacting

strategic plans.

About 68 percent of lab survey participants report planning for

growth within the next year. Among this subset, 39 percent plan to

update or replace existing capital equipment, while 24 percent intend to

invest in new types of capital equipment.

While significant, these levels of investment are less pronounced

compared to 2016, when 57 percent of respondents indicated they were

planning to replace or update capital equipment, and 29 percent were

planning to invest in new types of capital equipment.

In addition to cost pressures, consumer demand will playa new role in

shaping diagnostics. Robert Michel, publisher of The Dark Report,

predicted instances of point-of-care testing will triple over the next

eight years in part because it allows providers to more quickly supply

results to patients. He observed, “Patient expectations are not met by a

lab system that collects a sample on Tuesday and provides results to

the patient on Wednesday or Thursday.”

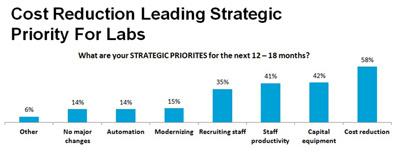

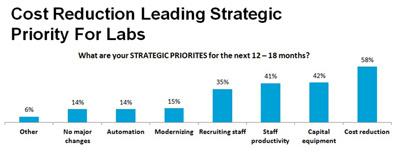

Labs focus on cost reduction

Even though most lab managers expect volume growth, 58 percent list cost

reduction as their leading strategic priority. To control costs,

managers are looking to reduce their supply budgets. More than half of

provider respondents have already cut their supply budgets, and even

more are looking to make cuts sometime in the next two years. This marks

a notable change from the 2016 survey, when only 35 percent expected

supply budgets to decrease. Providers also identified offering discounts

for cash payments, delaying capital expenditures, and standardizing

their products as ways to save.

At HIDA’s lab conference, Ran Whitehead, President and CEO of

PeaceHealth Labs, predicted PAMA implementation could result in fee

schedule cuts of up to 20 percent. Michel added the program is projected

to reduce spending by $5.5 billion over 10 years, including $400

million in 2018.

Diagnostics have untapped potential to lower healthcare costs, though

changing payer trends will drive more strategic use of testing that

reflects need and caters to patient expectations. To access the

Laboratory Care Market Survey, visit www.HIDA.org/MarketSurveys.

From http://www.repertoiremag.com/post-acute-hida-insights.html