The home healthcare market is expected to grow from $100 billion in

2016 to $225 billion by 2024. Key factors driving this expansion include

an aging U.S. population and the lower cost of home care when compared

to other post-acute settings. As the market continues to expand, the

number of providers offering home care services is expected to reach

46,000 in 2021, up from 37,000 in 2016.

HIDA’s 2017 Home Care Market Report offers an in-depth look

at home healthcare market conditions, as well as the factors affecting

utilization and demand. Below is a look at some of the key trends and

data points gathered for this new HIDA report:

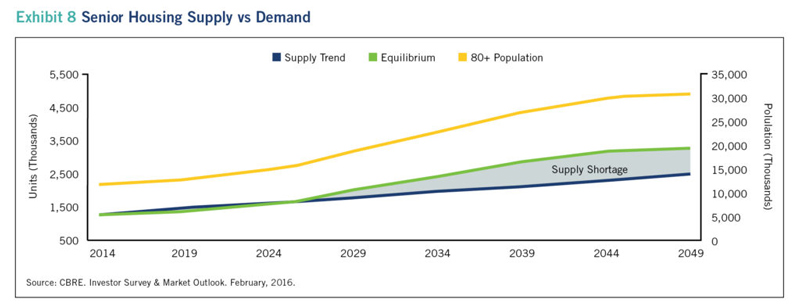

Due to the aging population, experts believe there will be a shortage

in senior housing (which includes assisted living, independent living,

memory care, and skilled nursing facilities) beginning in 2025 and

reaching 1 million units by 2049 if not addressed.

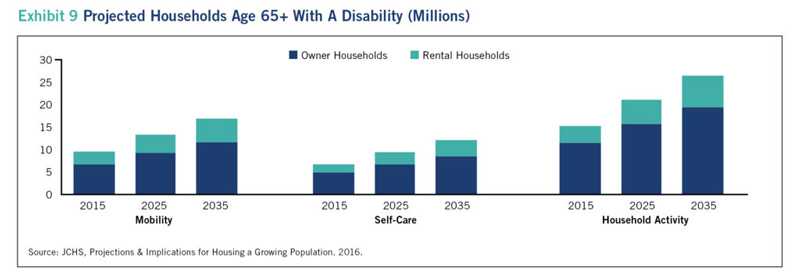

Projected Households Age 65+ with a Disability

The number of senior households with a disability are also expected to rise in the coming years. Between 2015 and 2035:

- Disabilities that limit movement will grow from 10 million to 17 million.

- Disabilities that interfere with an individual’s ability to care for themselves will rise from 6 million to 13 million.

- Disabilities that inhibit an individual’s ability to perform household chores will grow from 15 million to 27 million.

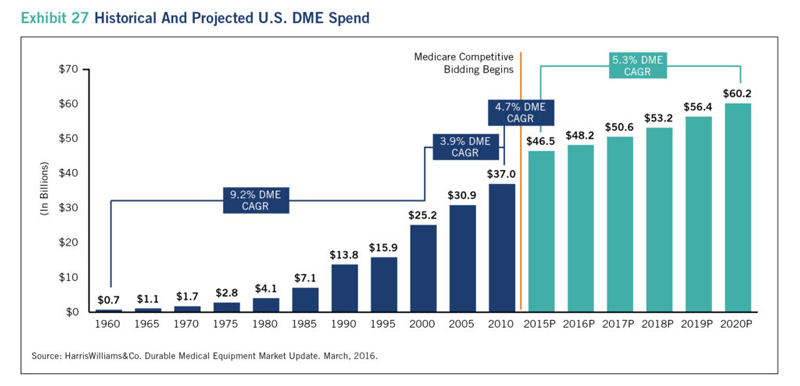

The increasing prevalence of both utilization of home care services

and chronic disorders requiring long-term patient care are expected to

contribute to higher spending on durable medical equipment (DME).

Because of this shift, the DME market is expected to reach $70.7 billion

by 2025, up from $50.6 billion in 2017.

Historical and Projected U.S. DME Spend

While there are several factors driving demand for DME, the Durable

Medical Equipment, Prosthetics, Orthotics, and Supplies Competitive

Bidding Program (CBP) will continue to limit DME suppliers’ Medicare

reimbursement. Under the current process, reimbursements cover, on

average, 88 percent of the cost of providing a piece of DME.

DME suppliers affected by the CBP are taking several steps to control

costs, including cutting staff, limiting product offerings, and

consolidating.

While these are some of the key trends affecting providers in the

home healthcare market, providers in this space will face several

industry challenges, including a shortage of skilled workers and key

payer changes.

For an in-depth look at these trends, purchase your copy of HIDA’s 2017 Home Care Market Report from www.HIDA.org/MarketReports.

From: http://www.repertoiremag.com/aging-u-s-population-to-drive-home-healthcare-market-growth.html